Introduction

Welcome to the first edition of Decoding Engineer Preferences. This research provides valuable insights into the information needs and preferences of European technical buyers, and builds on the strong foundation laid by TREW Marketing and GlobalSpec in the annual State of Marketing to Engineers report.

In this new collaboration between Elektor and TREW Marketing, the research is based on a survey of over 1,200 engineers and technical professionals across Europe and covers a broad range of topics, including search behavior, the use of AI tools, content preferences, and most valued marketing channels.

Decoding Engineer Preferences is designed to help you:

- Understand the information needs of European technical buyers

- Learn what information engineers are looking for at each stage of the buying process, so you can create relevant and engaging content.

- Identify the most effective marketing channels

- Discover the most popular marketing channels among European engineers, so you can focus your efforts on the channels that are most likely to reach your target audience.

- Improve your content strategy

- Gain insights into the types of content that engineers prefer, so you can create content that is more likely to be consumed and shared.

- Align your marketing and sales teams

- Educate leadership and sales teams about the needs and preferences of European engineers, so that everyone is on the same page.

Key Takeaways for Industrial Marketers

-

Engineers search deeply, with over half filtering through 4+ pages of results to find the information they’re looking for.

-

The most popular sources for information are online technical publications (84%) and vendor websites (75%).

-

Engineers consider GitHub, YouTube and Stack Overflow the most valuable social media platforms for work. TikTok was ranked the least valuable.

-

56% of engineers plan to attend at least one in-person event in 2024; while there, most are seeking to discover new vendors and attend highly technical sessions.

-

64% of engineers subscribe to 3+ newsletters, and half would like to receive newsletters weekly or daily.

-

Technical buyers find datasheets, technical publication articles, and product reviews/testimonials most valuable when researching to make a purchase.

-

89% of engineers watch work-related videos, and 73% of those would prefer short videos of 15 minutes or less.

-

48% of engineers spend half or more of the buyer’s journey online before engaging with sales, and email is the preferred way to interact.

-

Engineers look for assistance from sales because of the technical complexity of the solution, to seek pricing and inventory information, and to validate information gathered online. Only 7% of respondents said they’d prefer not to interact with a salesperson at all.

Survey Results

Seeking Answers

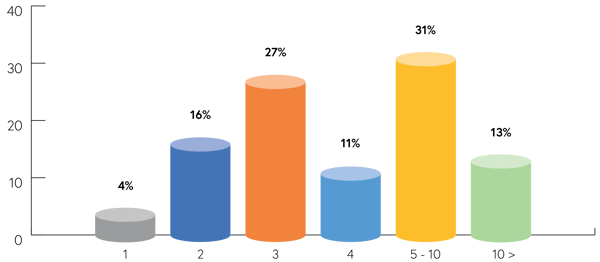

44% of engineers will filter through at least five pages of search results to find what they’re looking for. Only 4% stick to the first page of search results.

When searching for work-related information using a search engine, how many pages of results are you willing to review before you select a page to visit or restart your search? (n = 1135)

“Welcome to the era of the self-serve B2B tech buyer. According to recent data, B2C trends like convenience and access to easy-to- find product information like pricing and peer-to-peer reviews have infiltrated business buyers’ behavior. B2B tech buyers want all basic information at their fingertips and to validate with peers–without the gatekeepers.”

-- Gary Drenik, Forbes

When searching online, 58% of engineers avoid paid search links at all costs. However, if the paid link looks helpful for the search inquiry, 29% will click.

To see how engineers interact with paid search links, download the full report.

Channels & Site Organization

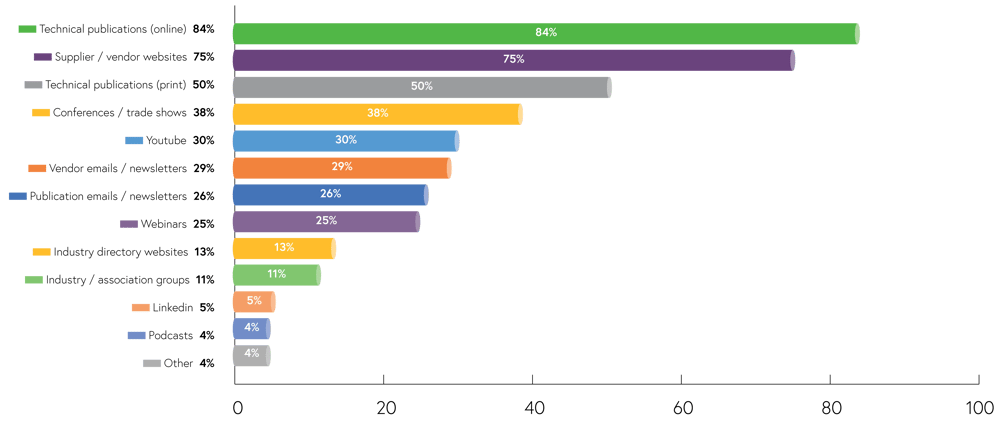

Most European engineers rely on online (1st) and print (3rd) technical publications when researching a specific product or service. A strong (2nd) role is reserved for supplier / vendor websites.

Where do you routinely seek information when researching a product or service for a work-related purchase? Multiple answers are possible. (n = 1139)

Content Preferences

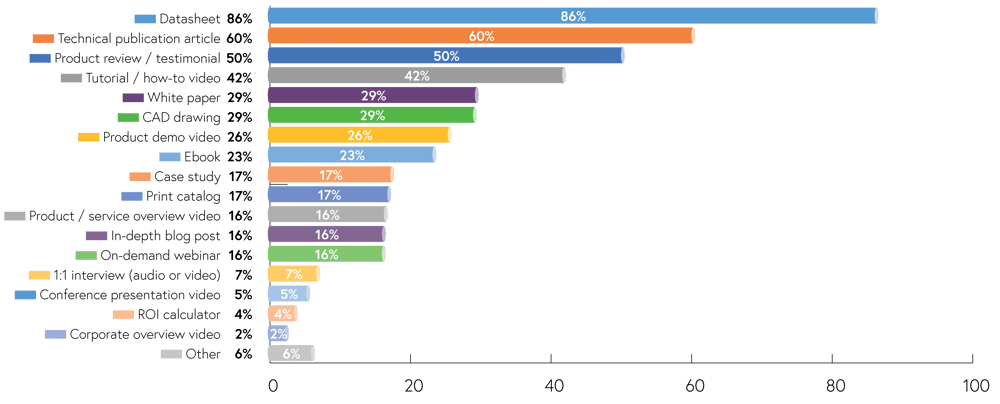

Engineers find datasheets (86%) to be overwhelmingly of most value in their decision-making processes. Secondary to technical documentation, engineers find value in content that provides information on use and implementation (e.g., product reviews, tutorials, and white papers). Consistent with the question on channels, technical articles (60%) are regarded highly in Europe.

What form(s) of content do you find most valuable when researching to make a significant work-related purchase? Please select all that apply. Multiple answers are possible. (n = 1197)

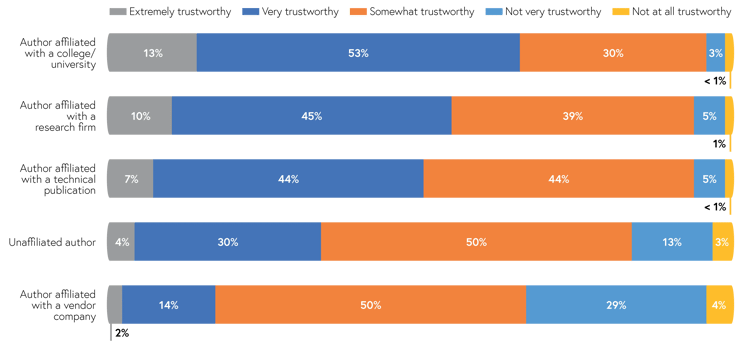

Content published by authors affiliated with a college/university, research firm, and/or technical publication is considered the most trustworthy from an engineer’s perspective.

Technical content can be written and published by a variety of professionals. To what extent do you trust each of the following expert authors? (n = 1153)

Newsletters

93% of engineers subscribe to at least one newsletter, while 71% subscribe to at least three newsletters. Of the non-subscribers, 79% are over the age of 45.

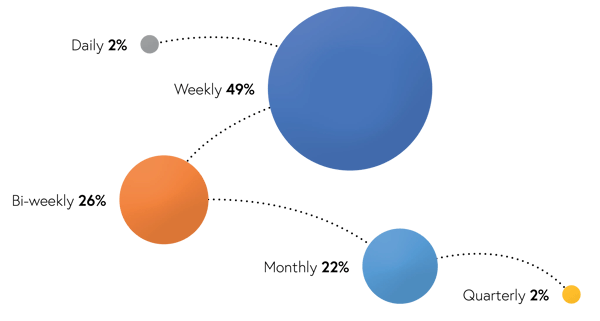

Weekly and bi-weekly delivery cadences are most preferred.

For newsletters you've subscribed to, what delivery cadence do you prefer? (n = 976)

To see what elements and content topics make a work-related newsletter a winner, download the full report.

Social Media & Sharing

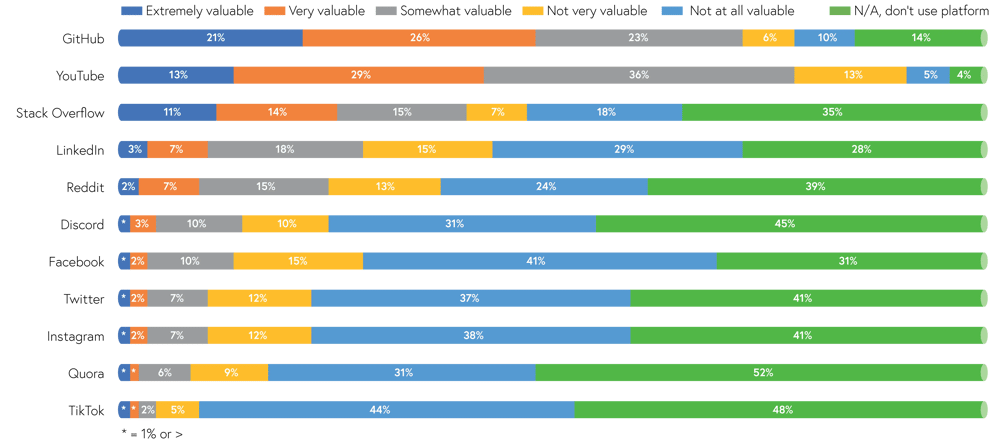

GitHub, YouTube and Stack Overflow help engineers stay up to date on the latest trends and technology.

How valuable are each of the following social media platforms when seeking information on the latest engineering technologies, industry trends, and products? (n=1035)

When reflecting on their time on LinkedIn, industry discussions and polls are the most eye-catching to European technical buyers.

When considering sharing work-related content, engineers are encouraged when they find information that is ungated and doesn’t require sharing information to access.

They’re also motivated by a strong, detailed story, relevant and shareable links and lastly, notable statistics and insights.

To see what types of content engineers find worth sharing on LinkedIn, download the full report.

Industry Experts

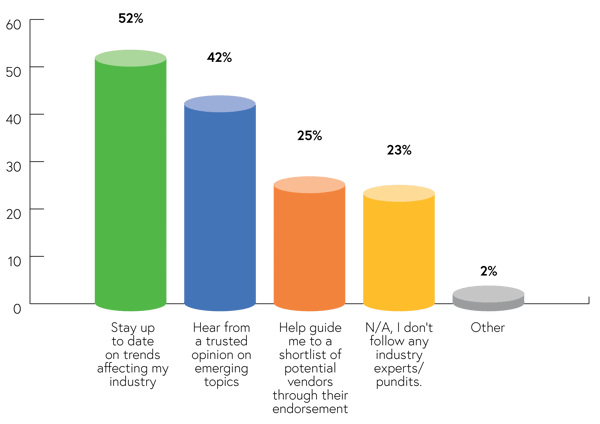

77% of engineers turn to some sort of expert(s) or pundit(s) in the industry. 52% seek information on industry trends, 42% seek trusted opinions, and 25% seek vendor endorsements. Of those who say they don’t follow industry experts, 81% are over the age of 45.

I look to specific industry experts / pundits to __________. Multiple answers are possible. (n = 993)

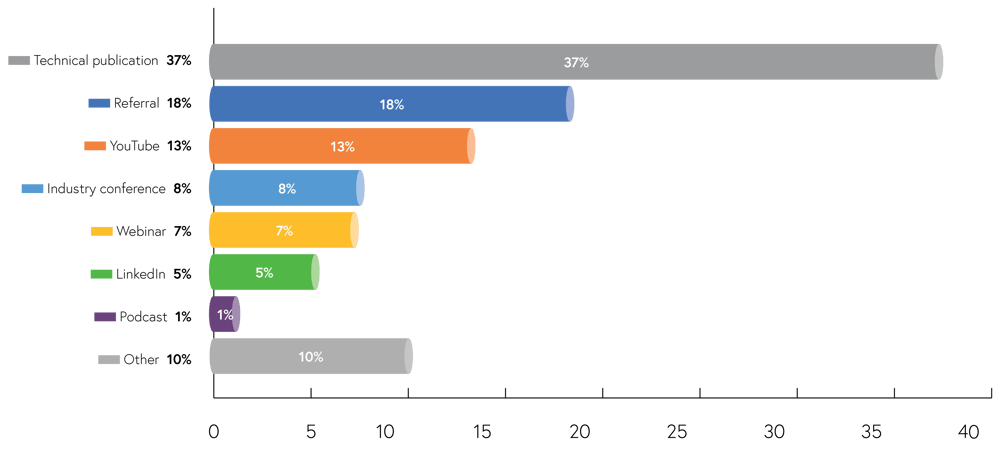

37% of engineers find industry experts and pundits through technical publications.

Think of your go-to industry expert / pundit. How did you discover them? (n = 770)

For a list of expert sources and perspectives named by survey respondents, download the full report.

Podcasts

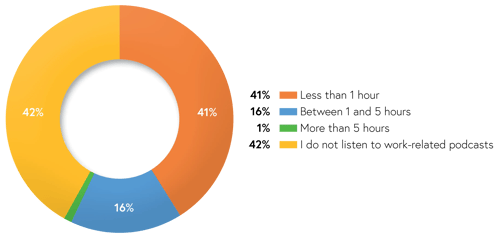

58% of engineers listen to work-related podcasts. 41% spend less than an hour listening to podcasts, while another 17% listen for an hour or more. Of those who don’t listen to work-related podcasts, 83% are over the age of 45.

Approximately how much time per week do you spend listening to work-related podcasts? (n = 1069)

“44% of senior-level decision makers make a concerted effort to listen to podcasts. The audio format of podcasts is appealing to key decision makers as it saves time, energy, and bandwidth and allows for multitasking.”

Videos

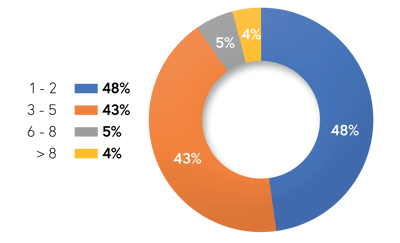

How many videos do you typically watch about a product or service before deciding to purchase it? (n = 947)

Of those who look at work-related videos, 84% would prefer a duration of 30 minutes or less. 72% say 15 minutes tops.

To see the more on the ideal length, as well as how much time per week is spent watching work-related videos, download the full report.

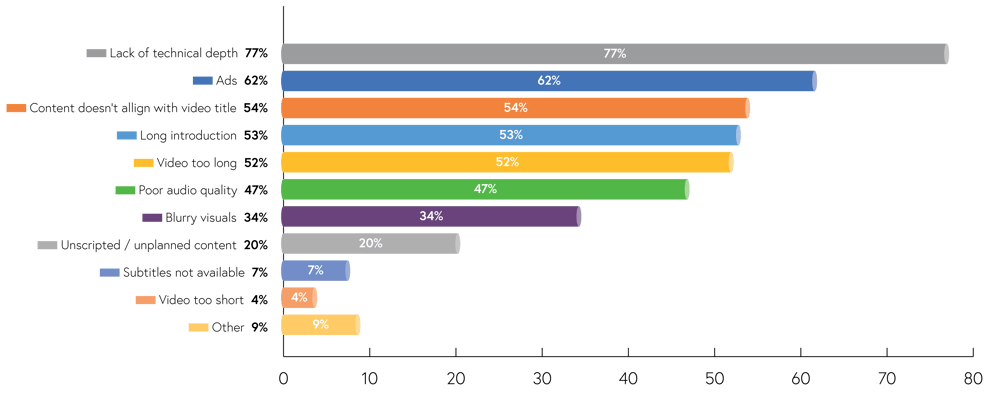

What makes you stop watching a product or service-related video to the end? Multiple answers are possible (n = 940)

In-Person Events

When thinking about the year ahead, 56% of engineers plan to attend at least 1 in-person industry event in 2024.

“Live events and personal encounter is unbeatable - a trusting partnership needs personal interaction! ... and trade fairs fulfill this in person interaction in an ideal way.”

-- Dr. Martin Lechner, Exective Director, Messe München

To see what elements most influence an engineer's experience and decision to attend an in-person event, download the full report.

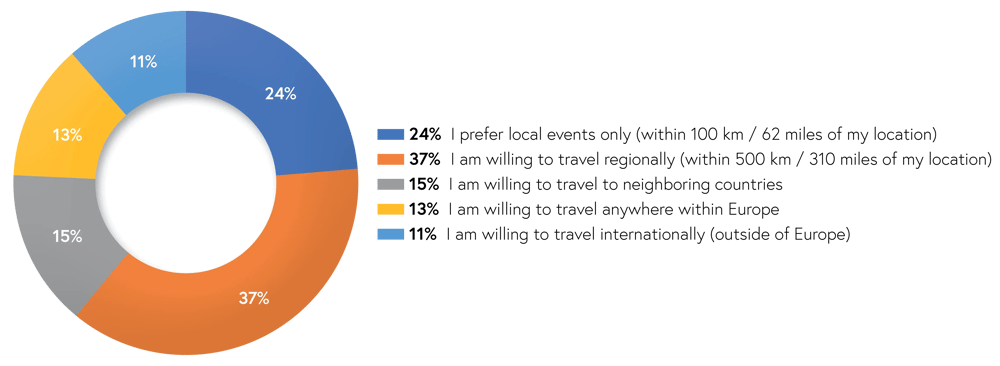

How far are you willing to travel for an in-person event (i.e. trade shows, conference) related to work? (n = 515)

Interaction with Sales

Engineers still spend much of the buying process online. 32% spend between a quarter and half of the buying process online, and 48% spend over half the buying process online.

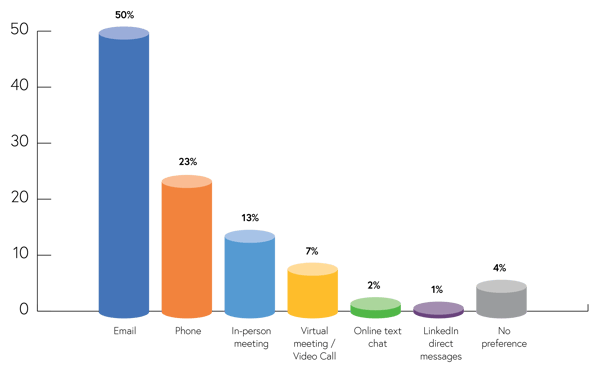

50% of engineers prefer their initial salesperson interaction to happen via email. 23% would prefer a phone call. In-person meetings are less desirable with only 13% selecting this as their preference.

When you are ready to speak to a salesperson at a vendor company for the first time, which of the following is your preferred method of communication? (n = 936)

Thinking of their most recent work-related vendor purchases, engineers say they were motivated to interact with sales because of the technical complexity of the solution. Only 7% of the respondents said they’d prefer not to interact with a salesperson at all.

For additional sales insights, download the full report.

Artificial Intelligence

When asked if using AI-based tools for work, an overwhelming 72% responded no. Only 15% were actively using AI-based tools, while 13% were not aware.

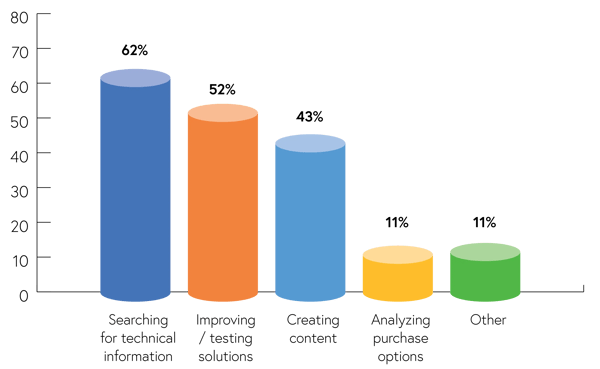

How are you using AI-based tools for work? Multiple answers are possible. (n = 178)

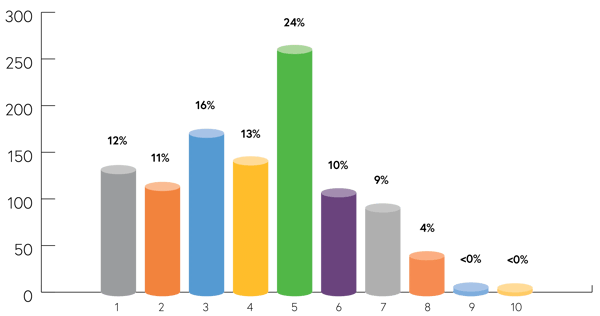

On a scale from 1 to 10, where 10 is complete trust, and 1 is a complete lack of trust, to what extent do you trust answers from AI-based tools? (n = 1058)

To see which AI-based tools are being predominantly used by engineers at the time of this survey, download the full report.

Watch the Webinar

Join Wendy Covey and Erik Jansen as they deep dive into European engineer marketing preferences based on the comprehensive research in Decoding Engineer Preferences.

In this exclusive session, we'll explore a broad range of topics, including search behavior, the use of AI tools, content preferences, and most valued marketing channels.

What sets this webinar apart is the unique perspective it offers. Building upon the research in the 2023 State of Marketing to Engineers report, Wendy and Erik will analyze and compare results, highlighting both similarities and differences.

Key Benefits and Takeaways:

- Understand the information needs of European technical buyers

- Learn what information engineers are looking for at each stage of the buying process, so you can create relevant and engaging content.

- Identify the most effective marketing channels

- Discover the most popular marketing channels among European engineers, so you can focus your efforts on the channels that are most likely to reach your target audience.

- Improve your content strategy

- Gain insights into the types of content that engineers prefer, so you can create content that is more likely to be consumed and shared.

- Align your marketing and sales teams

- Educate leadership and sales teams about the needs and preferences of European engineers, so that everyone is on the same page.

Wendy Covey

CEO and Co-Founder

TREW Marketing

Wendy Covey is a CEO, technical marketing leader, author of Content Marketing, Engineered, one of The Wall Street Journal’s 10 Most Innovative Entrepreneurs in America. Over the last 25 years, Wendy and her team at TREW Marketing have helped hundreds of highly technical companies build trust and fill their pipelines through inbound marketing.

Erik Jansen

Managing Director

Elektor

Erik Jansen began his career in 1999 at an independent Internet Service Provider and later led the online business of the largest entertainment retailer in the Netherlands. In 2010, he pursued his entrepreneurial ambitions in online publishing. In 2012, his company was acquired by Elektor, the company he now leads as the Managing Director.

About

About Elektor

Elektor is an international electronics magazine that has been inspiring and informing professionals and hobbyists in the electronics field for over 60 years. With a focus on cutting-edge technology, DIY electronics projects, and tutorials, Elektor offers a wealth of valuable information for anyone interested in the field of electronics.

Whether you're a professional engineer looking to stay up-to-date on the latest industry trends or a hobbyist looking to build your own projects, Elektor has something to offer.

About TREW Marketing

TREW Marketing, founded and headquartered in Austin, Texas, is a strategy-first agency for engineering companies with highly complex, technical solutions. Driven by insightful research and unrivaled industry expertise, TREW builds marketing foundations with branding, drives engagement with content plans and marketing automation, and sustains growth through a targeted multi-channel approach.